.10 Financial Beliefs to Adopt Before the Stock Market Crashes (Again).

Dear Reader,

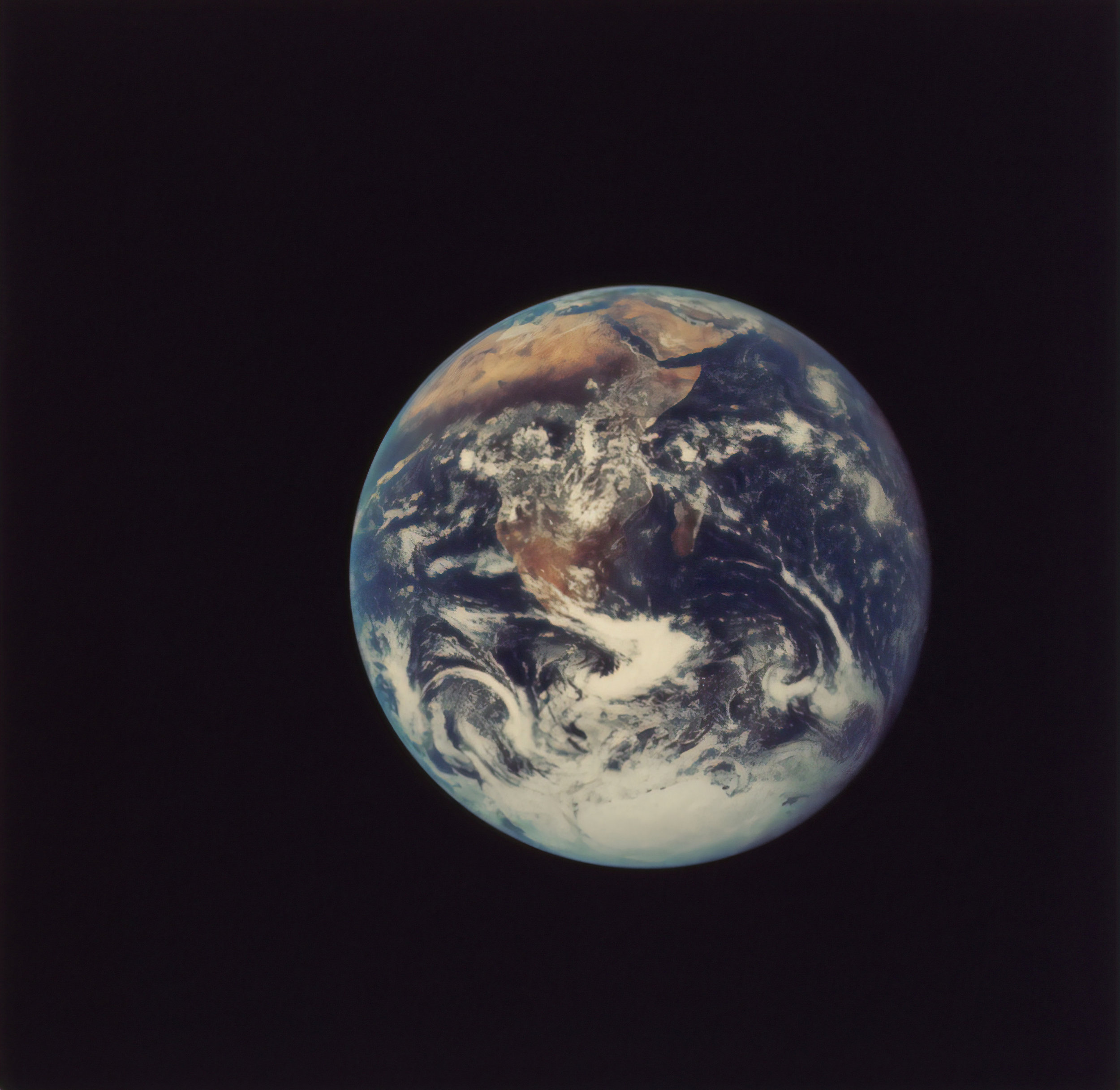

Financial wellness is one of the eight areas of wellness that I am committed to writing to you about. Part of a well-rounded life is ensuring that you are financially sound and secure. Financial security and even abundance is a possibility for all of us. Remember, wellbeing for you should and will benefit wellbeing for us all (for me, for we).

I will review some other areas of financial wellbeing (saving, budgeting, emergency funds, money beliefs), but first a question for you - are you invested in the stock market?

If not, please start researching the benefits! A quick search online should suffice. And on this page, I plan to discuss more pros, cons, considerations about the stock market and investing here as a platform (note: I am not acting as a financial advisor! only providing ideas for you to research and discuss with trusted financial advisors).

Know this - investing is one of those areas where the concept of planting a tree applies (i.e. the best time to invest was 20 years ago, the second best time is today!).

For those who are already invested (those who are not yet, keep reading and return to this when you do invest!) below are some great pointers that I gleaned from experts in the market. This is advice from 1995… over 20 years ago. Just like my article title, this information provided over 2 decades ago impresses how predictable the market is at a high level - it will go up and it will go down.

When the stock market is at its worst- I buy or I hold, but I do not sell.

I am a long-term investor and I know the stock market will always come back. I will sleep secure knowing that history is on my side

If the stock market posts a 30 percent loss or greater, I will move into more aggressive stock funds, such as small company, growth, and aggressive growth funds. Even if stocks fall further, I will stay cool, calm, and confident

When stocks start back up, I will hold or buy more, I will not sell. Waiting to get back in is bogus and I will not fall for it. Nor will I take short-term gains. I am going for big, long-term winners

I will not read, listen to, or believe negative stories during the crash. I know things are never as good as they seem when you are winning and never as bad as they seem if you are losing. The blessed media will probably be uniformly negative if we have a real barn burner of a crash

I will not change my investment objectives while the stock market is down. Nor will I become a ‘safety first’ investor under emotional duress so that I decide to sell stock funds and buy money market funds. I will either maintain the same asset mix or consider adding to stock funds

I will not worry that stock prices could go lower. When everyone is scared and the market had just had that big crash, I will buy as much as I can because people who are afraid or procrastinate, and who are looking for a bottom, tend to miss the bottom and then do not get back in

I will make sure anything I buy was hit be a decline. In other words, I will not buy anything that did not go down because it probably will not go up. I want to use a big market break to buy quality stocks cheaply

I will make a note to myself to not look at all stocks I bought for a good three years. After a big break like that, the standard thing people do is buy stocks and hold them for six months to a year. They forget a big break is usually a precursor to a big bull market

Finally, I will remember that every big break generates a new generation of gloom-and-doomers. I will ignore them because if they did not forecast the crash, they are not good forecasters.

If you did not notice, I think this is great financial information for me to share from a Stoic viewpoint as well. Many of the beliefs above call us to practice virtues that Stoics value more than finances - courage and wisdom. These financial beliefs above call us to have the courage to be calm in a situation that is so easily frustrating, to practice wisdom when preparing for the inevitable to occur (a crash), and to practice wisdom again when acknowledging that the market certainly will recover in the future.

Now that you’ve read these financial beliefs, did you note where you agree or disagree with these 10 points? Is your reaction because of the current financial climate? Do you agree or disagree based on currently held financial beliefs? Let me know your thoughts in a comment below.

In Sympatheia, The Holistic Stoic

This article references 10 concepts directly from Herb Greenberg’s Article, “Save This Column and Don't Use It Until the Market Crashes”, originally published in 1995.

Photo by @cgbriggs19